Commodities have started a more differentiated trend since July, and the epidemic has also restrained the rising pace of many varieties, but soda ash followed slowly.

There are several hurdles in front of soda ash:

1. The manufacturer’s inventory is very low, but the hidden inventory of the glass factory is high;

2. Solar energy production capacity expansion, but not now;

3. The new contract meets expectations and is too overdraft.

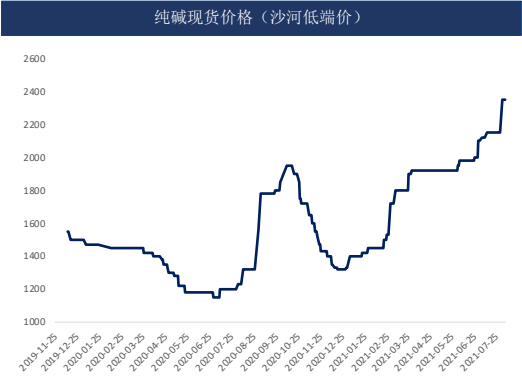

In early August, the spot price increased by about 200 yuan. At present, the lowest spot delivery price is 2350 yuan/ton (delivered at Jinshan insured price), and some high-price areas are 2400-2500 yuan/ton. There is still fear of heights and cautious transactions in the downstream, soda factories have sufficient orders and cargo transportation is smooth.

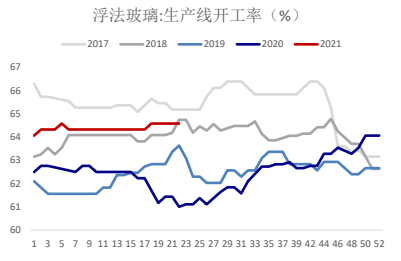

As of Thursday, the domestic float glass production lines remained unchanged, with a total of 306 lines and 265 lines in production, with a daily melting capacity of 175,325 tons, the same as last week.

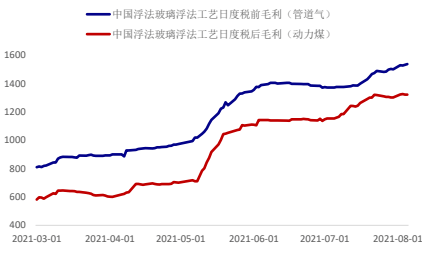

浮法玻璃行业平均利润为1425.89元/吨,较上月微增12.86元/吨,周内综合行业利润较上月增长0.91%。

玻璃是纯碱的直接下游,玻璃的良好需求对纯碱有直接的带动作用。但玻璃厂积累了大量纯碱库存,导致提前出现阶段性供需矛盾。

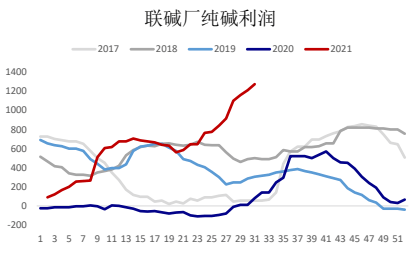

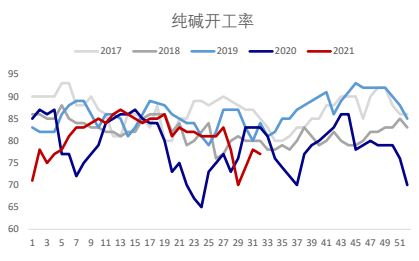

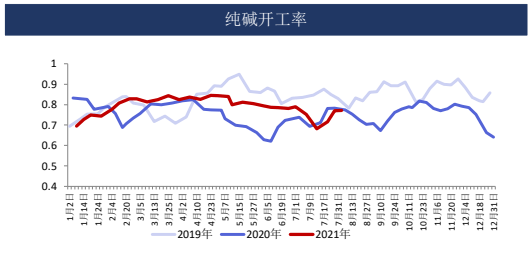

This week, the weighted average operating load of soda ash manufacturers was 77.4%, a slight decrease from last week; profits were high, and the double-ton profit of Hou’s soda manufacturers increased to about 1100-1200 yuan.

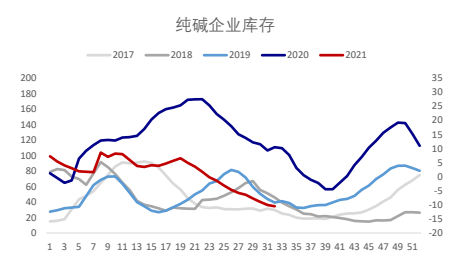

This week, the inventory of soda ash manufacturers was about 340,000 to 350,000 tons, a decrease of 4.2% month-on-month and 68.7% year-on-year. The cumulative inventory fell for the thirteenth week.

The overall operating rate of soda ash during the week was 77.14%, and last week was 77.04%, an increase of 0.1% from the previous week. The co-production operating rate was 74.57%, down 3.73% month-on-month. The operating rate of ammonia base was 79.15%, an increase of 4.27% from the previous month.

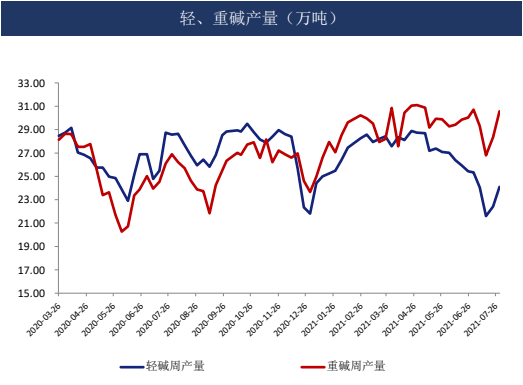

The output of soda ash during the week was 547,300 tons, an increase of 0.11%. The output of light alkali was 248 thousand tons, an increase of 7 thousand tons from the previous month. The output of heavy soda was 299,300 tons, a month-on-month decrease of 6,300 tons.

Heavy alkali is mainly used in glass production, and one ton of glass requires 0.2 tons of heavy alkali. Light alkali is mainly used in the production of some daily chemical products. The soda ash in the futures is heavy soda, why should we pay attention to both? Because light alkali is the upstream of heavy alkali, if the price of heavy alkali rises, light alkali producers will turn to produce heavy alkali because of the temptation of profit, which will increase the supply of heavy alkali and pave the way for the price increase of light alkali.

At present, it can be seen that due to the stable daily chemical demand, the output of light alkali fluctuates regularly, but due to the good demand for glass, the output of heavy alkali remains high, which also verifies the contradiction between the supply and demand of heavy alkali.

Views of the July glass soda ash survey:

1. In the past, the inventory time of soda ash in the glass factory was one month, but in the near future it was from February to March. On the one hand, it is to prevent the price from rising rapidly, and on the other hand, it is also for the needs of safe and smooth production. Most manufacturers are optimistic about the long-term price of soda ash;

2. The building-integrated photovoltaic industry is currently only a pilot. Once the demand for soda ash increases, the attitude of manufacturers to store more soda ash can also explain this. Compared with glass, they are more optimistic about the medium and long-term demand for soda ash;

3. Soda ash supply side is unlikely to be out of stock in the short term. A delivery warehouse has large quantities of soda ash, which corresponds to the 2109 contract, and gradually increases the volume near the delivery, and the supply is sufficient;

4. On the whole: the supply of soda ash is generally stable at a relatively high level, and the demand side is mainly based on two aspects: one is construction and real estate, and the demand for glass may be expected to be concentrated in the front; the second is the background of “dual carbon”, photovoltaic and other clean energy The industry has great potential for development. Once the building-integrated photovoltaic industry is widely promoted, the demand for soda ash will be great. The demand is expected to be good, and the medium and long-term soda ash may continue to be optimistic.